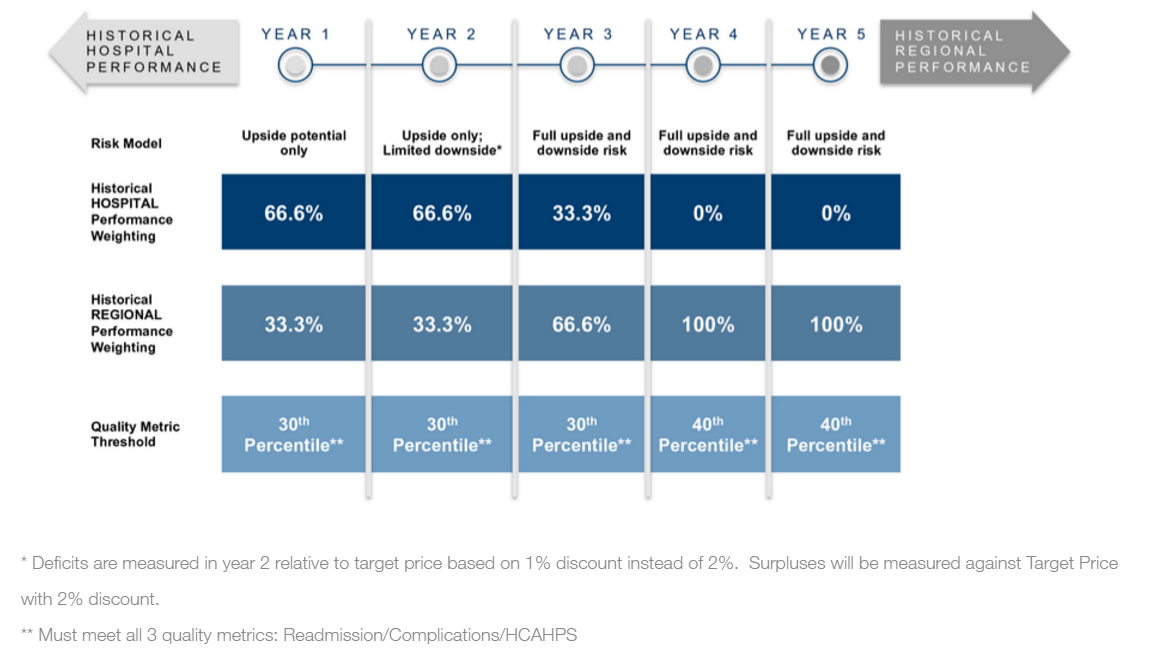

The Comprehensive Care for Joint Replacement Program, the first mandatory bundled payment program from CMS, began April 1. Under the CJR, almost 800 hospitals in 67 geographic areas will be partially at risk for all Medicare spending related to lower joint replacements (DRG 469 and 470), from initial admission to 90 days post-discharge. Hospitals’ performance will be compared to both their historical spending and regional spending levels, which regional spending becoming increasingly important over time. In addition to meeting target pricing, hospitals are responsible for meeting minimum quality and satisfaction measures. Here’s a breakdown the methodology:

With responsibilities now extending beyond discharge, hospitals need to act quickly to understand the post-acute care process. Using that newly acquired knowledge, the challenge will be to reengineer care delivery outside of the hospital walls to optimize outcomes and reduce costs. According to an analysis by Avalere, 60% of hospitals will need to reduce costs in order to remain competitive with their regional competitors. Those organizations that wait to act could very well find themselves spending the next five years playing from behind, always trying to catch up with everyone else in the region only to find themselves continuously outpaced and losing money. As many analyses have noted, too, the vast majority of variation in LEJR payments occurs in post-acute care. As a result, post-acute providers must pay particular attention to their relationships with acute care partners during the CJR rollout.

(Analysis by DataGen)

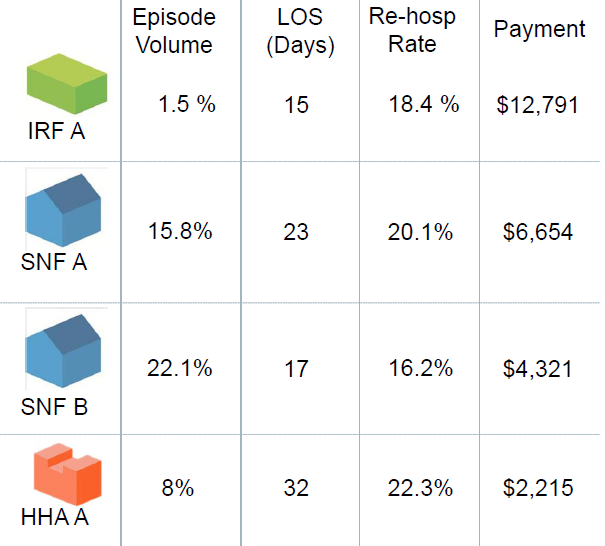

It will no longer be sufficient for post-acute providers to compare themselves to others simply by looking at star ratings or occupancy. Instead, providers need to understand the current flow of Medicare patients from acute care partners through the post-acute journey, and begin benchmarking themselves against competitors based on rehospitalization rates, lower average lengths of stay, higher satisfaction, and access to preferred referral networks.

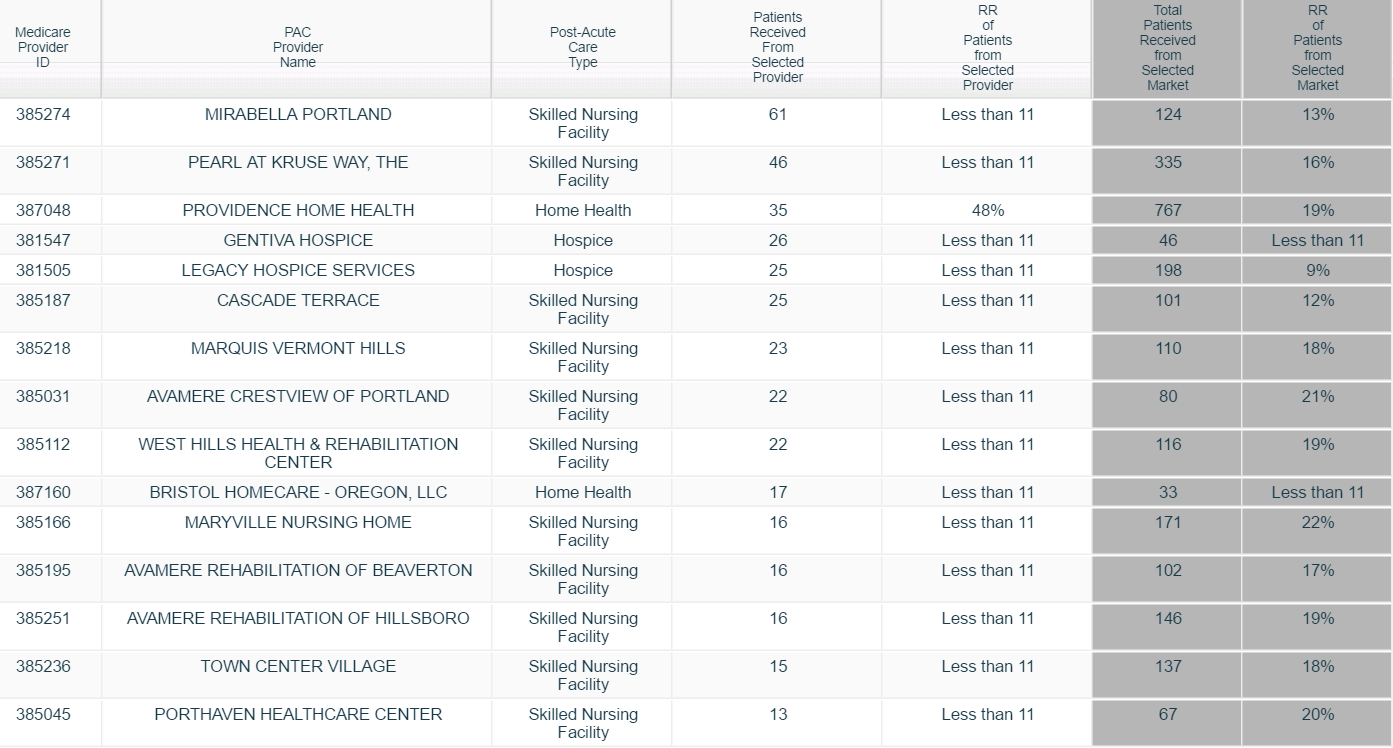

This example, from the Portland metropolitan market, shows post-acute flows from an area hospital. Using this information, PAC providers can better understand their competition and target hospitals that might benefit by referring more patients to their facility.

The April 1, 2016 start date has put pressure on hospitals to quickly ramp up. On the other hand, the fact that the first year (through December 31, 2016) has no downside risk may cause some organizations to take a slower pace understanding their downstream costs and challenges. This is a big mistake. Since the CJR applies to all hospitals in the geographic region, those that start early will have a continuing advantage over the life of the program.

As part of the CJR, CMS has waived certain restrictions on telehealth, gainsharing and patient support (including providing remote home monitoring technologies). PAC providers with extensive home health networks will be at a particular advantage to test out new technologies, such a tele-therapy, remote home monitoring, and active case management as an alternative to extensive skilled nursing stays and potential hospital readmissions.

For post-acute providers looking to excel in this new environment, here are some key considerations:

Without a doubt, the CJR is only the first of the mandatory bundles providers can expect in the near future. CMS will likely move very quickly to expand both the geographic reach and the DRGs of these value-based models as it looks to shift entirely aware from a fee-for-service-model. Post-acute care providers are a crucial component in the healthcare space, but they will only remain so by focusing on better outcomes at lower costs.